We could probably sum up all of today’s news items (except our lament that LeVar Burton was not selected as host of Jeopardy) just by saying that the money system is screwed up. Since that would hardly fill trhe page, here are some specific reasons we have for saying that:

|

| Saving for consumption leads to poverty. |

• The Wrong Question. More and more we’re seeing little news (disguised ads) that ask the question, “Have you saved enough for retirement?” or some variation. Going on various projections such as how long you expect to live, where you expect to do it, do you want to travel, eat, sleep, or wear clothing, the answers vary from, “You don’t have quite enough,” to “Get the location of the nearest poorhouse.” Then (of course) the pitch comes for whatever speculation disguised as investment they’re pushing. Here’s the real solution: instead of saving for retirement consumption, save for current investment. That way you don’t have to worry whether you have enough saved to finance future consumption, you can calculate immediately whether the projected income from your investments is enough to cover future consumption. And the catch? There isn’t one. All you must do to finance future consumption out of future investment income is change how you save. Instead of cutting consumption now to consume in the future (although you do want to build up a cushion for emergencies and unexpected expenses, of course), you increase production in the future by buying capital that pays for itself out of its own future profits, and thereafter provides consumption income. In other words, instead of accumulating now to disburse later, you accumulate now to keep. The way to do that is detailed in the Economic Democracy Act.

|

| It's a legal pyramid scheme backed by legal counterfeiting |

• Social Security COLA. The buzz is that the Social Security Administration is getting ready to announce the largest cost of living adjustment in forty years — a whopping 6% — which raises some interesting questions. First, of course, is the need to dispel the prevalent misimpression that the money you pay into Social Security is a contribution that the government credits to your account and that earns interest, all of which is paid out to you on retirement or when you otherwise qualify for distributions. Bologna. FICA is a tax, not a contribution. It’s not “your money” anymore. There was even a case back in 1960, Flemming v. Nestor (363 U.S. 603 (1960)), in which the Supreme Court of the United States affirmed that you do NOT own what you pay in, and you therefore have no right to get anything out. Congress, in fact, very carefully reserved to itself the right to “adjust benefits” (and note the word benefits, which implies that it’s a gimmie or a gift, not a right of property) at any time . . . up or down. Technically (although it would be political suicide) Congress could suspend all Social Security payments for any reasonable cause at any time, and even terminate the program unilaterally. You could — in theory — never see one cent of that money. The most important question, however, is where are “they” going to get the money to pay for the rumored 6% increase? There is nothing in the Social Security trust fund except government debt, and it’s the government that “owes” you the money in the first place . . . if it decides to pay. The only viable solution is to shift people’s retirement income to their own investments and use Social Security as a safety net based on need. This can be done by implementing the Economic Democracy Act.

• Jeopardy. LeVar Burton would still have been a better choice.

|

| Guess who REALLY owes on government debt? |

• Raising the Debt Ceiling. If you want to know what happens when you fall victim to the greatest financial hoax in history (Keynesian economics and MMT), take a look around you. If that’s not enough to convince you that something is wrong, consider the fact that the government has created such an incredible amount of money backed with its own debt — none dare call it counterfeiting — that the situation has become surreal. The projected deficit is now 128% of GDP, which be scaring the pants off of everyone, but instead of trying to figure out ways to stop spending and reduce the debt (such as the Economic Democracy Act), all they can do is make it a question of “patriotism” to spend more! (“Raise the Debt Ceiling,” The Washington Post, 08/11/21, A-23.) In other words, if you don’t destroy the country with debt, you’re a traitor.

• The “Death Knell” Tax. Distributists and Localists Arise! You have nothing to lose but your ownership! Senator Chuck Grassley of Iowa has altered people to the dangers inherent in the current proposal to add additional “death taxes” on to the current inheritance tax law by denying a “stepped-up basis” for inherited assets such as family farms and businesses. This means that assets are taxed at the difference between the original price and the current value . . . which given the way the government has issued its counterfeit currency has artificially inflated values of many things, dramatically increasing the so-called “capital gain” on sale of assets held for years . . . when there might not be any real gain at all. (“A ‘Death Knell’ Tax Threatens Family Farms and Businesses,” The Wall Street Journal, 08/12/21, A-17.) Here’s a simple solution that would satisfy justice, if not government greed: inflation index all capital gains. For example, suppose a farm cost $100,000 originally, and the dollar has inflated 1,000% in the interim, i.e., $1 when the farm was purchased is “worth” $10 today. Suppose the farm is sold for $500,000 and the taxes are levied at a rate of 50%. Not adjusting for inflation, the seller owes $200,000 in taxes on the “gain” ($500,000 - $100,000 x 50% = $200,000). Now let’s inflation index that transaction. The selling price and the taxes due remain the same, of course — we’re adjusting the original cost upwards to show what really happens in real value terms. The seller still owes $200,000 in taxes, of course, but it’s not on any imagined gain, it’s in addition toa huge loss, $500,000, to be exact. ($500,000 - $1,000,000 = -$500,000.) Given that the inflation-adjusted real value of the farm at the original purchase price, the seller has lost 70% of the total value of the asset by being taxed on the inflationary “gain.” The government has stolen from the taxpayer twice, once by inflating the currency and again by taxing a loss.

• Hortense and Her Whos. In case you’ve been wondering how you might advance the Just Third Way by introducing it to legislators at any and all levels of government, we’ve made it easy for you, with the “Hortense Hears Three Whos” initiative. Visit the explanatory website, and consider downloading the postcard to send to people in government. Don’t worry if you think they won’t be open to it, as the postcard is intended to get them to open their eyes.

• Economic Personalism Landing Page. A landing page for CESJ’s latest publication, Economic Personalism: Property, Power and Justice for Every Person, has been created and can be accessed by clicking on this link. Everyone is encouraged to visit the page and send the link out to their networks.

• Economic Personalism. When you purchase a copy of Economic Personalism: Property, Power and Justice for Every Person, be sure you post a review after you’ve read it. It is available on both Amazon and Barnes and Noble at the cover price of $10 per copy. You can also download the free copy in .pdf available from the CESJ website. If you’d like to order in bulk (i.e., ten or more copies) at the wholesale price, send an email to publications@cesj.org for details. CESJ members get a $2 rebate per copy on submission of proof of purchase. Wholesale case lots of 52 copies are available at $350, plus shipping (whole case lots ONLY). Prices are in U.S. dollars.

• Sensus Fidelium Videos, Update. CESJ’s series of videos for Sensus Fidelium are doing very well, with over 150,000 total views. The latest Sensus Fidelium video is “The Four Pillars of a Just Market Economy.” The video is part of the series on the book, Economic Personalism. The latest completed series on “the Great Reset” can be found on the “Playlist” for the series. The previous series of sixteen videos on socialism is available by clicking on the link: “Socialism, Modernism, and the New Age,” along with some book reviews and other selected topics. For “interfaith” presentations to a Catholic audience they’ve proved to be popular, edging up to 150,000 views to date. They aren’t really “Just Third Way videos,” but they do incorporate a Just Third Way perspective. You can access the playlist for the entire series The point of the videos is to explain how socialism and socialist assumptions got such a stranglehold on the understanding of the role of the State and thus the interpretation of Catholic social teaching, and even the way non-Catholics and even non-Christians understand the roles of Church, State, and Family, and the human person’s place in society.

|

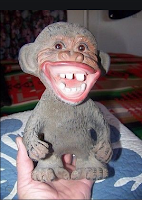

| "Why shouldn't I smile?" |

• Shop online and support CESJ’s work! Did you know that by making your purchases through the Amazon Smile program, Amazon will make a contribution to CESJ? Here’s how: First, go to https://smile.amazon.com/. Next, sign in to your Amazon account. (If you don’t have an account with Amazon, you can create one by clicking on the tiny little link below the “Sign in using our secure server” button.) Once you have signed into your account, you need to select CESJ as your charity — and you have to be careful to do it exactly this way: in the space provided for “Or select your own charitable organization” type “Center for Economic and Social Justice Arlington.” If you type anything else, you will either get no results or more than you want to sift through. Once you’ve typed (or copied and pasted) “Center for Economic and Social Justice Arlington” into the space provided, hit “Select” — and you will be taken to the Amazon shopping site, all ready to go.

• Blog Readership. We have had visitors from 31 different countries and 35 states and provinces in the United States and Canada to this blog over the past week. Most visitors are from the United States, Australia, Ireland, the United Kingdom, and Canada. The most popular postings this past week in descending order were “Abolishing Private Property,” “The Expanded Ownership Revolution,” “News from the Network, Vol. 14, No. 31,” “The Magic of Future Savings,” and “The First Problem Principle of MMT.”

Those are the happenings for this week, at least those that we know about. If you have an accomplishment that you think should be listed, send us a note about it at mgreaney [at] cesj [dot] org, and we’ll see that it gets into the next “issue.” Due to imprudent language on the part of some commentators, we removed temptation and disabled comments.

#30#